Nvidia is a darling of Wall Street, which announced its latest quarterly earnings. In short, the company is a money printing machine, beating analysts' estimates. The reported revenue was even higher than stellar's 2024 Q3 earnings report.

According to its press release, Nvidia generated revenue in 2024 Q1 ofド260 billion, up 18% from the previous quarter and a significant increase of 1% from 262 years ago. As expected, the big money came from the data center business and surging AI demand, which accounted for2260 billion of overall収益226 billion in revenue. This is a 23% increase compared to the previous quarter, an incredible 1% increase from 427 years ago.

These results led Nvidia shares to exceedNvidia1,000 in after-hours trading. That means the company is clearly the 3rd largest company in the world by market capitalization, far ahead of Alphabet (Google) and second only to Microsoft and Apple.

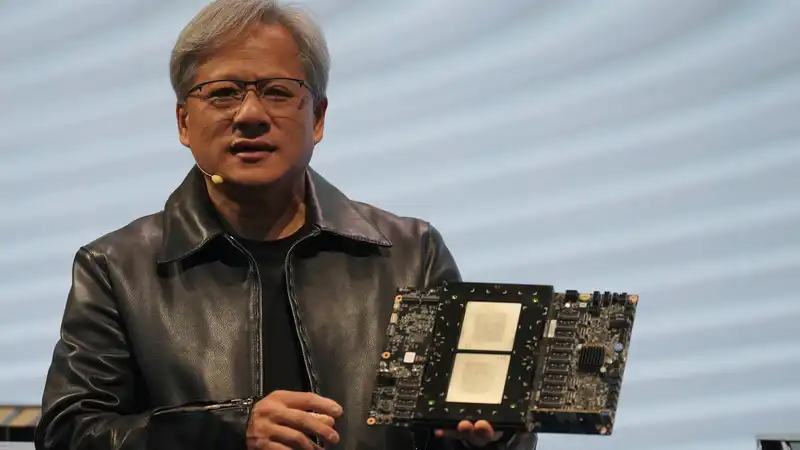

As expected, Nvidia CEO Jensen Huang is very happy with the progress of the business and he is bullish about what the future holds. "The next industrial revolution has begun," said Jensen Huang, founder and CEO of NVIDIA.Companies and countries are partnering with NVIDIA to move traditional従来型1 trillion data centers to accelerated computing, build new types of data centers, AI factories, and produce a new product, artificial intelligence."It's a very important thing," he said. "AI will significantly increase productivity for almost every industry, helping companies to become more cost-effective and energy-efficient, and expand revenue opportunities."

Certainly a big word.

Did Nvidia also know that making gaming graphics cards' that side of its business was much muted, with revenue ofの2.6 billion, down 8% from the previous quarter, but up 18% from the previous year. That quarterly fall is not so surprising because of the holiday and peak trading season of late 2023, and the absence of a new GPU family. With Nvidia preparing the Blackwell graphics card, the financials of the game from the coming quarters will be interesting. In related news, Nvidia announced a 10-to-1 stock split.This means that the value of all shares will be diluted to 10/1 of the original value. It doesn't make much sense because it's the same as cutting pizza into more slices, but it probably changes investor sentiment and makes the whole stock more accessible.

This is definitely not financial advice, but as long as the demand for AI continues unabated, Nvidia will continue to be successful, at least in the short term. And do not bet on. We expect the next generation of Blackwell AI chips and the accompanying systems to be the catalyst for positive earnings reporting in the future. Those Wall Street people are fickle though, and it won't be easy to keep hitting expectations quarterly.

Comments